Creative Destruction and the Social Contract

We are rightly proud of the economic achievements capitalism and hard work have brought to the US, but free market capitalism is not a flawless mechanism. I have posted elsewhere about income inequality. Here I want to focus on an overlooked consequence of creative destruction.

Here’s the definition from MIT economics.

Creative destruction refers to the incessant product and process innovation mechanism by which new production units replace outdated ones. This restructuring process permeates major aspects of macroeconomic performance, not only long-run growth but also economic fluctuations, structural adjustment and the functioning of factor markets. Over the long run, the process of creative destruction accounts for over 50 per cent of productivity growth.

Here are two significant forces that lead to creative construction.

Technology

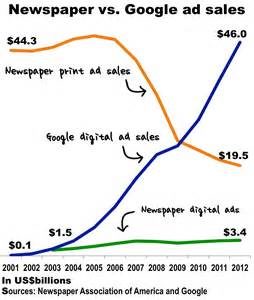

Technology changes are unavoidable these days and in general lead to greater wealth, although some industries and their employees are hurt by the change. Let’s consider the rise of the internet and one particular area with winners and losers.

The shift from reading news in physical papers (with inflexible schedules) to getting information on items of interest from an electronic device (able to display the latest stories) was a technology-driven revolution.

At first both avenues grew. Newspaper ad revenue grew (2001-2006) while the Google ad stream also grew in that time frame. Then, the ad money shifted from newspapers to Google (2007-2012) and probably continuing. The rapidity of the change to online ads is astounding. Newspapers have not died, as evidenced by the remaining $19.5B ads in 2012. From an operational perspective, it is imperative to realize that the newspaper cost structure (salaries and fixed expenses) quickly became too large for their diminished ad revenues.

The newer, more flexible, and cheaper-to-the-end-user web-based method is a positive example of creative destruction, although to those in the newspaper business it is a bitter reality. Also, we have to consider whether the news we read or see in the Internet is based on fact.

Financial

However, creative destruction arises in businesses because of financial innovations.

A company’s viability can change dramatically under different financial conditions. In some cases, government programs encourage creative destruction.

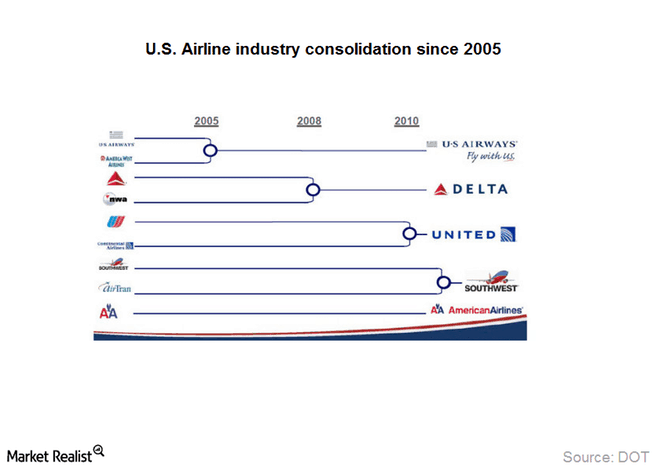

Consider this situation. US airlines were under extreme financial pressure earlier in the decade. A number of factors are involved, but a fundamental problem is that older, more established airlines have to fund retirement funds at a level that forces their ticket prices to be uncompetitive.

Consider the large sloughing of United’s pension liability (NY Times 5/11/2005) over to the PBGC (Pension Benefit Guarantee Corp). That lowered pension benefits for many United Airlines retirees. The Airline industry consolidation chart shows the concentration occurring. American Airlines tried to push its pension liabilities to PBGC, which resisted. American Airlines then declared bankruptcy.

In the case of older companies declaring bankruptcy, they repudiate their debts, including pensions. Established companies or newly formed companies can buy up the physical stock of the old company. The purchasing companies start with a clean slate, no pension liabilities, enabling them to charge less, while providing the same service.

Business media call this creative destruction at work, getting rid of non-competitive companies. That ignores the fact that the gain in productivity is actually the breaking of the pension pledge.

The victims are people, middle-class workers and retirees of the vanished company, not the company. These people no longer have the pensions they were promised.

Financially engineered creative destruction is permitted but it is done on the backs of the working men and women. The shifting of pension liabilities to the public PGB should not be allowed in mergers or in purchases of entire companies that have declared bankruptcy.

Many established industrial and service companies (like GM, Ford, GE, BofA, the coal industry) face a same funding calculus. Capitalism, as we practice it in the US, has an inherent, unchecked tendency to favor the bankruptcy of existing companies, even in profitable sectors.

Societal Cost

Financial engineering is not a natural, free market process. It is artificial sleight-of-hand, hiding the cost of productivity gains. This is a breach of the social contract. The social contract (follow the law and you can earn a good lifestyle) is broken.

Can society expect citizens hurt by creative destruction to follow their responsibility to the law, when their reward from honoring the social contract has been violated?

1 thought on “Creative Destruction and the Social Contract”