An Empire of Wealth. John Steele Gordon

Subtitle: The Epic History of American Economic Power by John Steele Gordon. Published 2004.

I like to read economic texts that are not fresh off-the-press. It gives a chance to see how prescient, how well-grounded are the author’s explanations.

Some particular points Gordon made worthy of note.

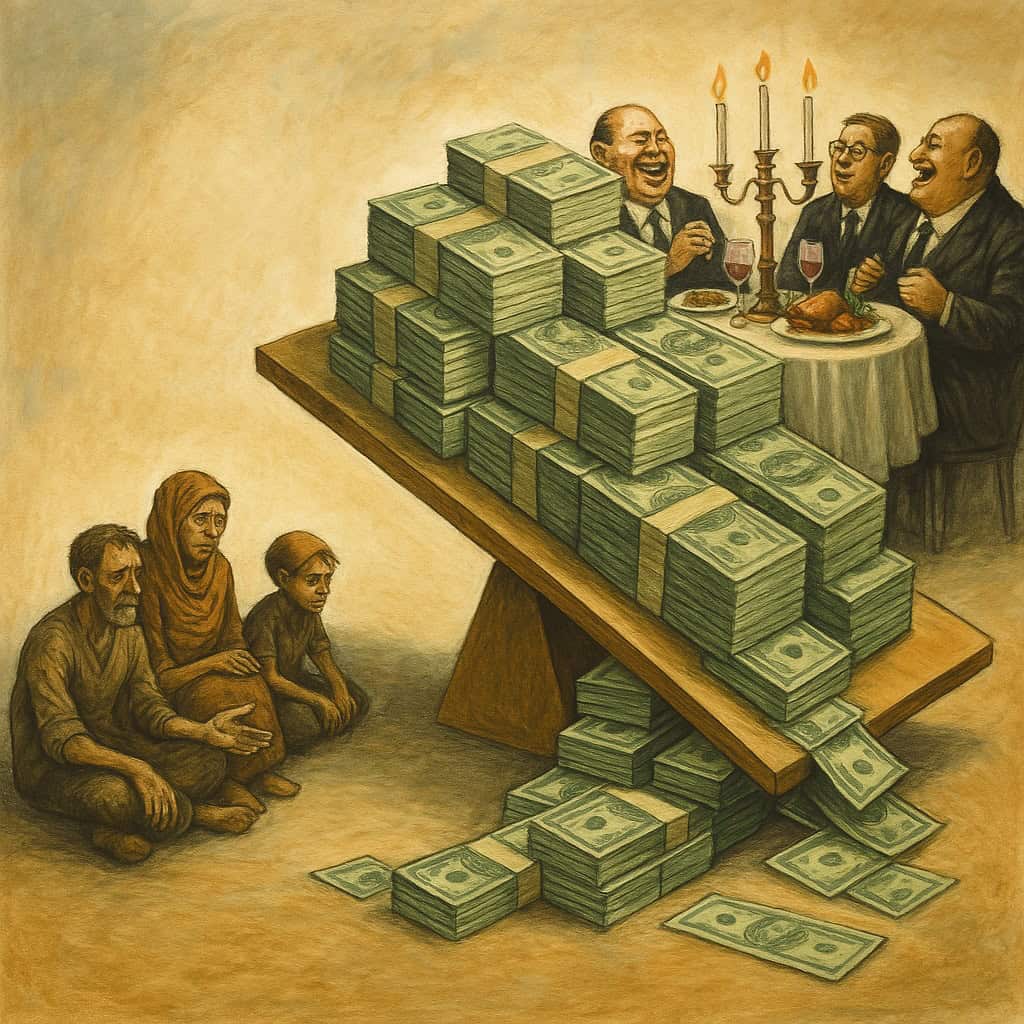

p 49 this prosperity was widely shared among the population—in the 1770s the top 20 percent of the population owned about two-thirds of the wealth, while the bottom 20 percent owned only 1 percent

Interesting to compare to present inequality. 2013 chart shows top 20 percent with 84 percent of wealth, while the bottom 40 percent owned only 1 percent

p 55 People with an economic advantage, however “unfair” that advantage may be, will always fight politically as hard as they can to maintain it. And because the advantage of the few is specific and considerable, while the cost to the disadvantaged many is often hidden and small, the few regularly prevail over the many in such political contents.

FDR summed it thusly, “It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach.”

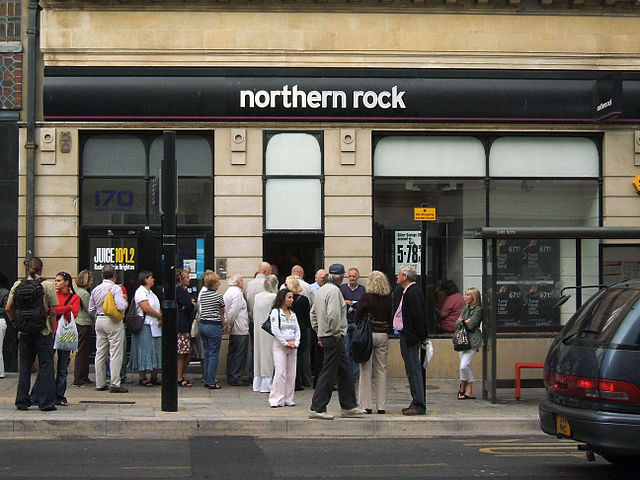

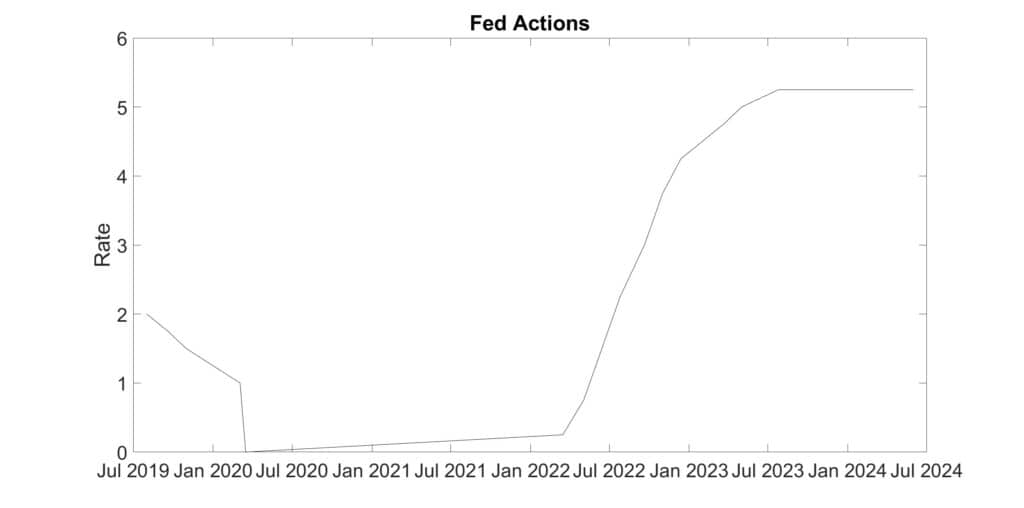

p 81 The success of the Bank of the United States and its obvious institutional utility for both the economy and the smooth running of the government did not cause him [Jefferson] to change his mind at all about banks. He loathed them all. … would destroy Hamilton’s financial regulatory system and would replace it with nothing. As a result, the American economy, while it would grow at an astonishing rate, would be the most volatile in the Western world, subjected to an unending cycle of boom and bust whose amplitude far exceeded the normal ups and downs of the business cycle.

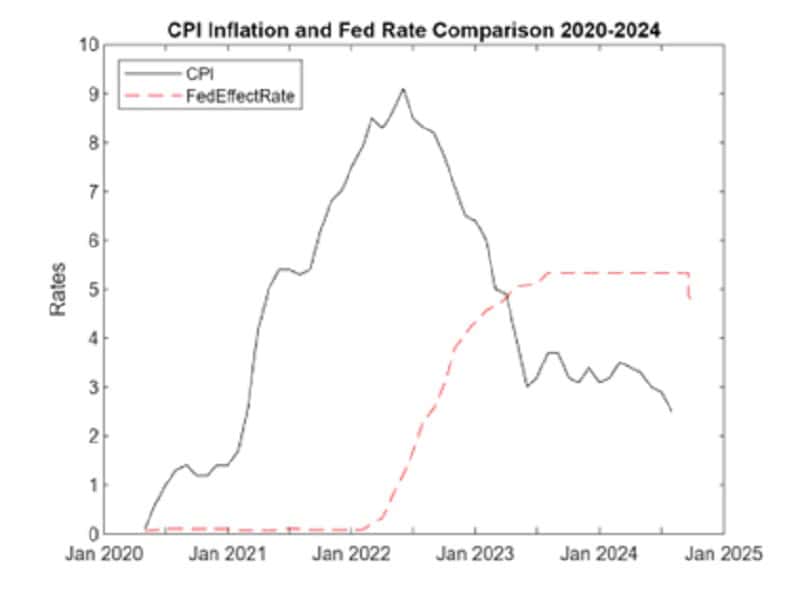

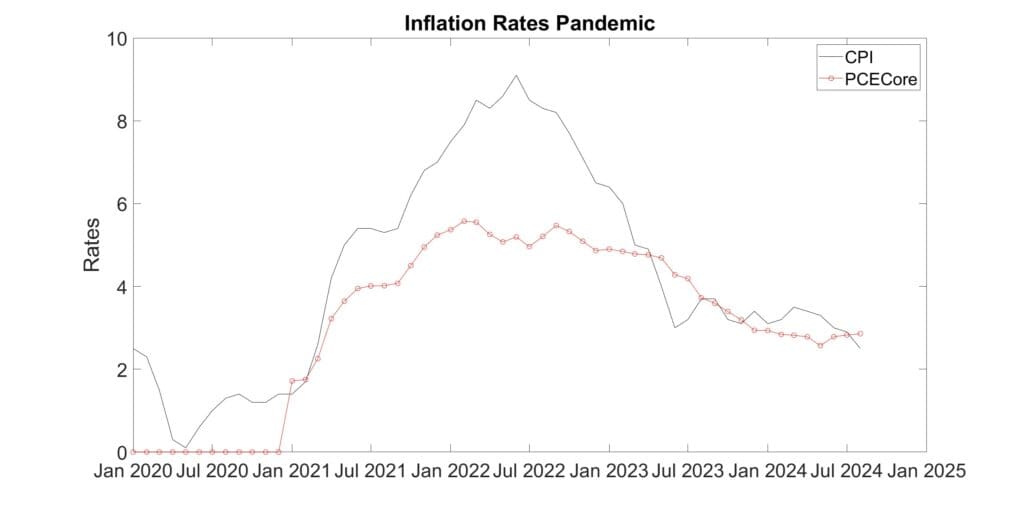

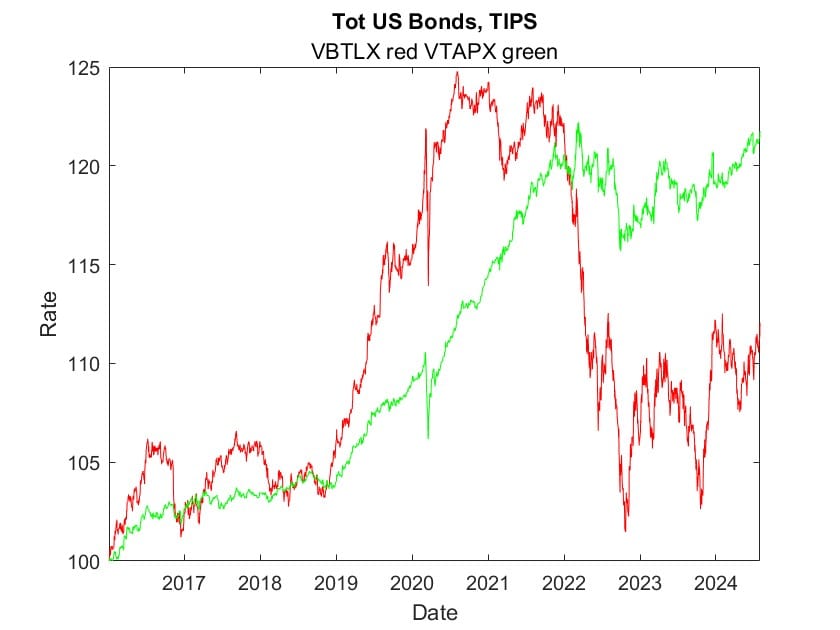

Argument for the Fed in some form, as a bulwark against economic booms and busts which falls hardest on the poorest.

p 256 It is simply a myth that monopolies will raise prices once they have the power to do so. Monopolies, like everyone else, want to maximize profits, not their prices. Lower prices, which increase demand, and increased efficiency, which cuts costs, is usually the best way to achieve the highest possible profits.

That is true in some situations, but in no way supports the general conclusion that it “is usually the best way to achieve the highest possible profits.” Just ask Bill Gates. He didn’t use the windows monopoly to lower their prices. He kept its price elevated far beyond what a competitive price would be.

p 256 What makes monopolies (and most of them today are government agencies, from motor vehicle bureaus to public schools) so economically evil is the fact that, without competitive pressure, they become highly risk-aversive—and therefore shy away from innovation—and notably indifferent to their customers’ convenience.

p 338 Glass-Steagall also greatly weakened the largest and strongest banks … The separation of deposit and investment functions into noninterlocking companies was required because having the two businesses under the same management was thought to create an inevitable conflict of interest that had exacerbated the banking crisis of the early 1930s. In fact, the evidence for this was slight …

Whistling in the graveyard.

p 401 The distinction between investment banks and deposit banks created in the 1930s by Glass-Steagall was repealed, as was much of the distinction between brokers and bankers and insurance firms. At last, the United States had a banking system that matched the American economy in both scale and scope.

I didn’t start with a specific intent to find fault with the economic narrative. On the whole there’s much to admire about the book; nonetheless, the antagonism to the Glass-Steagall Act was striking in that it reveal Gordon’s short-sightedness. Totally oblivious to the coming financial crisis, with banks taking massive risks with depositors money that the government, not banks, had to guarantee.

1 thought on “An Empire of Wealth. John Steele Gordon”